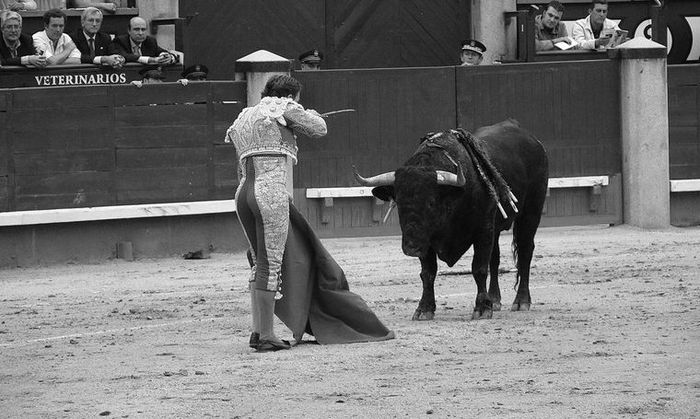

Bullish case for macro outlookBY BCA RESEARCH | VOLUME 14, ISSUE 4 BCA Research has been the market's leading source for independent global macro research for 70 year. Occasionally, this independence has resulted in strongly diverging views. Get articles like this delivered to your email - Sign up for the free weekly newsletter More Articles |

Latest News

ASIC releases new relief for reportable situations regime

ASIC has provided AFSLs new reliefs to help them manage the reportable situations regime, which includes extending the length of investigations reportable from 30 days to 60 days.

TA Associates invests in Viridian Financial Group

TA Associates announced it will make an undisclosed investment in Viridian Financial Group to help the latter accelerate its next phase of growth.

Shaw and Partners splashes $63m for New Zealand expansion

Shaw and Partners Financial Services, a subsidiary of EFG International, has acquired a 75% stake in Auckland-based Investment Services Group (ISG) for NZ$67.5 million ($62.5m).

4600 relevant providers yet to meet qualification standards: ASIC

More than 4600 relevant providers have yet to meet qualification standards, according to ASIC, and have only six months to meet the deadline.

Further Reading

Cover Story

Moving mountains

MAGDELINE JACOVIDES

FOUNDER & FINANCIAL PLANNER

MAZI WEALTH

FOUNDER & FINANCIAL PLANNER

MAZI WEALTH

On top of running a successful practice, Mazi Wealth founder Deline Jacovides is a fierce advocate for closing the superannuation gender gap and has built a highly popular social media presence that takes financial literacy to the next level. She tells Karren Vergara where her passion comes from and how she integrates it all with family life.