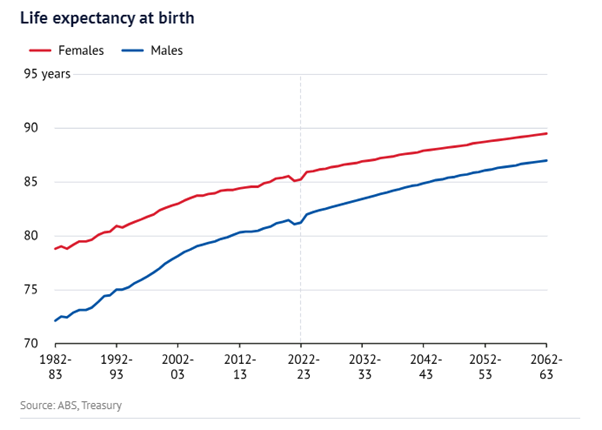

Defending the right to a long, comfortable retirementBY KATRINA KHOUPONGSY | WEDNESDAY, 1 MAY 2024 1:50PMWhen it comes to investing, the word defensive is synonymous with fixed income and cash but equities can also display defensive characteristics. While classic portfolio construction broadly categorises asset classes along growth and defensive lines, and places equities firmly in the growth bucket, some stocks have low levels of historical volatility and are inherently less risky. They could be described as defensive equities because they display the growth profile of equities with less volatility. For conservative investors who don't have the stomach or time horizon to take on too much risk but need capital growth from their investments to fight inflation and keep pace with the rising cost of living, exposure to defensive equities may play an important role. Demand for defensive strategies that seek to deliver equity-like returns but limit losses has been steadily increasing, reflecting Australia's rapidly ageing population and the return of inflation to levels not seen for a generation, against a backdrop of economic uncertainty. Add to that list the fact Australians are living longer than ever and it's easy to see the appeal, particularly among the nation's 4.1 million retirees, according to the ABS. Life expectancy in Australia today is 84.3 years on average compared to 78 years two decades ago, and that is only expected to improve.

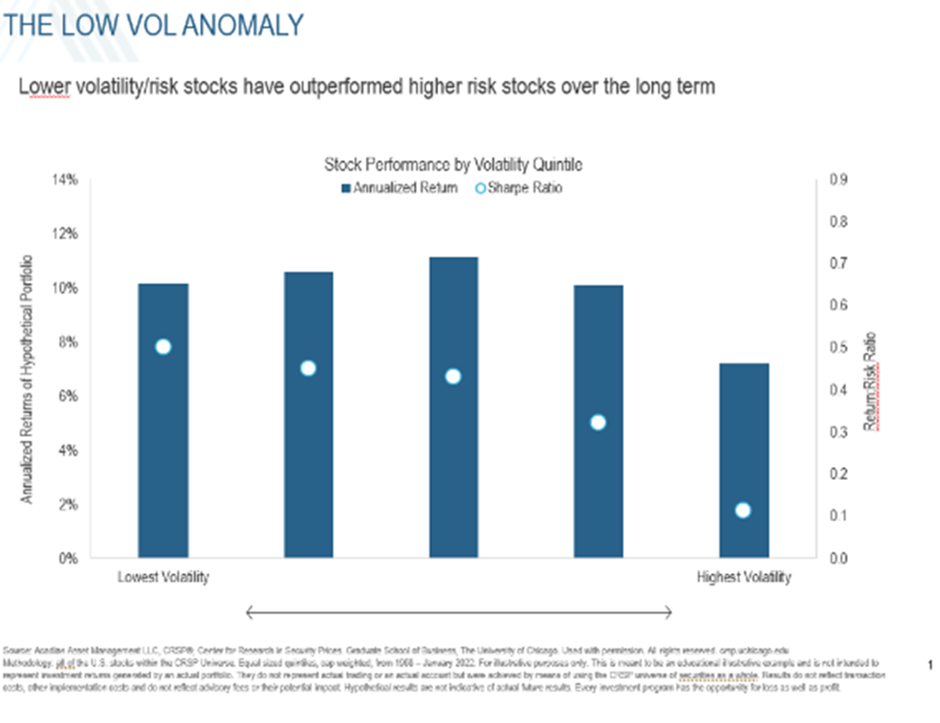

According to the government's 2023 Intergenerational Report, Australians are expected to continue living longer and remain healthier to an older age. Over the next 40 years, the number of Australians aged 65 and over will more than double and the number aged 85 and over will more than triple, Treasury estimates show. As such, longevity risk - the possibility of outliving one's savings - is a major concern for retirees and a key influence on their retirement planning and, in turn, their lifestyle and level of satisfaction in retirement. Managed volatility To combat longevity risk, the obvious options are to work longer, save more and have an exposure to investments that can provide some capital growth. While Australians are being encouraged to extend their working life, with the age at which people can qualify for the age pension recently rising to 67 (for those born after 1956), this is not an equitable or realistic long-term option. According to an Australian study published by Lancet Public Health in August 2023, the majority of workers aged over 65 are men in professional or managerial roles, as these jobs are better able to accommodate declining health. For those in manual, labour intensive roles, working longer may not be viable. Table: Most common forms of employment for Australians over age 65, May 2021 Putting aside issues related to physical and cognitive decline, older people also face challenges finding suitable employment due to ageism and discrimination. Furthermore, current super rules, which include contribution caps, limit the amount people can tax effectively save for retirement. The Age Pension eligibility rules also curb the ability of older Australians to work while receiving pension entitlements. As such, maintaining an exposure to investments that aim to provide some capital growth is an extremely important lever for managing longevity risk. Managed volatility or low volatility strategies generally aim to deliver market-like returns with 20-25% less volatility than the market by exploiting the low volatility anomaly. In finance, the low volatility anomaly refers to observations that low volatility stocks have achieved higher risk-adjusted returns than high volatility stocks in most markets, over the long term. This contradicts the common belief that higher risk equals higher returns.

Based on research by Acadian Asset Management called 20 years of low volatility equities, a managed volatility portfolio commonly outperforms cap-weighted benchmarks in large down markets but underperform those benchmarks in strong up markets. By investing in a managed volatility strategy, investors have the potential to eliminate the high highs and low lows, achieving a smoother ride while exploiting the mispricing of risk. Planning for the future Over the next five years, 670,000 additional Australians will enter retirement, according to the ABS. After decades of hard work, this should be a happy time. They should be thinking about spending more time with family and friends, going on holidays and relaxing. They should not be fearful about rising living costs or running out of money. Effective retirement planning and smart investment decisions, including exposure to defensive equities, may help ensure a good night sleep. |

Latest News

CSLR levy underspend expected as claim processing slows

Count Financial class action dismissed

Industry groups hammer out guidance on tax-deductible advice fees

Cost-of-living, unaffordable advice fuels financial stress: Surveys

Cover Story

Moving mountains

FOUNDER AND FINANCIAL ADVISER

MAZI WEALTH