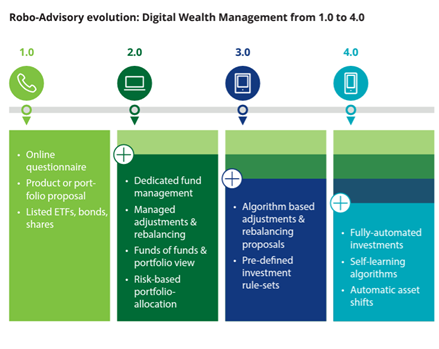

In limbo: Robo-adviceBY KARREN VERGARA | MONDAY, 18 DEC 2023 4:42PMThe fate of Australia's robo-advisers hangs in limbo as the triple threat of spooked investors, lackadaisical client interest, and regulatory strangulation are too enormous for many providers to overcome. Once considered as one of the country's leading robo-advisers, the demise of Six Park after a six-year run casts indelible doubt about the role automated investing plays in serving the masses with simple, affordable advice. Four-year-old Upstreet, which automatically invests fractional shares from purchases with its partner companies, folded in early September. They join a string of fintechs that found it impossible to survive, let alone scale, in this economic environment. Advice Intelligence self-declared it was in voluntary administration, but the lack of paperwork submitted to ASIC failed to prove it ever reached this status. Before it flatlined, and like any other company facing an existential predicament, it would have exhausted every avenue to try and survive, knocking on any potential buyer remotely interested in rescuing it. Fortunately for Advice Intelligence, GBST saved it from extinction in July. GBST also salvaged Creativemass' financial advice software WealthConnect, declining to disclose how much it paid for the two companies. "Capital markets remain challenging and despite positive rhetoric from industry participants, broad adoption unfortunately has not happened to date," Six Park co-founder and chief executive Pat Garrett says. "Therefore, our decision to cease the service is a regrettable one, but a very considered one, with our clients and shareholders' interests in mind." Unlike Creativemass and Advice Intelligence, Garret says Six Park is "definitely not in voluntary administration" but has "scaled back the staff and ceased the service as currently deployed" and is open to redeploying the application to the right acquirer or partner. But it was Stockspot that won the major backer lottery. Mirae Asset Global Investments pumped $28 million into the robo-adviser, optimistic that this boost of confidence will enable it to expand its "cutting-edge technology". Mirae's investment dwarfs the $3 million cash injection from a consortium that included Alium Capital and H2 Ventures and led by ETF Securities founder Graham Tuckwell in May. The consortium invested an initial $2.2 million in 2017. Also an exception, active fund manager Ellerston Capital helped launch Super Obvious in early 2023, an ethically based robo-adviser that screens certain industries, despite the dismal landscape. Like for many across the industry, news of Six Park's demise was a surprise and disappointment to Peter Worn, joint managing director of Finura Group, as he says it is "a really high-quality firm that was trying to build a good product". "I think there was good intent around what they were trying to do, but time conspired against them as the desire from investors to keep investing in those sorts of businesses has long gone," Worn says. Micro-investor Raiz is faring relatively better amongst its peers, boasting 685,000 customers and $1.2 billion in funds under management at the end of June. Customers have on average balances of $3823. Yet it is now ditching its presence in Indonesia and Malaysia as losses continue to balloon, sinking in the red by $8.1 million at the end of FY23 and failing to turn in a profit since it listed in 2018. The challenge that Six Park and other robo-investing providers have had is a commercial one, says Worn. "The cost of acquiring a new customer is very high, particularly going direct to customers, meaning that charging a relatively low percentage of assets as a fee can take many, many years to break even," he says. Garden path The forced closure of two robo-advisers in 2019 operating under Lime FS is a cautionary tale of why robo-advisers may never progress from their current state or worse still, never reach the zenith of providing holistic, affordable advice. Launched in 2014, Plenty Wealth provided budgeting, life insurance reviews, tax and investment, and superannuation recommendations, while Plenty Plus focused on SMSFs and super-related advice. ASIC said the tools did not meet the same legal obligations required of human adviser, fearing that the advice was not appropriate to the client and did not comply with the best interests duty. ASIC questioned the quality of advice being generated by the robo-advice online tools and its ability to monitor that advice. In some instances, the recommendations conflicted with client goals or other recommendations also generated by the same tool. Lime FS co-founder Greg Einfeld disputed ASIC on several fronts. Einfeld told Financial Standard at the time that it consulted with ASIC at every stage of the process to make sure it was operating within the rules of the law. ASIC ultimately forced the robos to shut down. "Through our dialogue with ASIC, we have formed the view that it is overly challenging to provide holistic digital advice within the constraints of the existing regulatory framework," Einfeld said. "Unfortunately, the further steps we would need to take (over and above the extensive steps we have already taken both proactively and responsively) would not be commercially viable for us at this point in time." Robo-advisers canvassed by AMP and KPMG unanimously argued that they need more clarity and guidance from the regulator so that they can provide personal advice with confidence. Many fear of crossing blurred regulatory lines and treading into personal advice territory. Quality of Advice Review chair Michelle Levy summarised many of these issues in her findings. The reluctance to commit time, capital, and resources to set up digital advice systems coupled with the rate of regulatory reform continues to be so high, she found, that the barriers that existed 20 years ago are as evident as ever. Amidst the regulatory complexity, providers see the obligations applying to the provision of personal advice as "not only difficult but uncertain," Levy says. "All of the specialist digital advice providers said they valued and wanted more engagement with ASIC. I understand that ASIC does engage with the industry and some digital advice providers told us that that engagement was helpful. It will plainly help the industry and ASIC if there is open discussion about new digital advice tools, how they work and what they can offer to consumers." ASIC can also help robos further if it updated its regulatory guide to include case studies, she suggested. "These discussions will assist ASIC to think about whether changes might be needed to regulatory guides or ASIC instruments and even from time to time the law to assist more digital advice providers to enter the Australian market," Levy says. Drop in the ocean Robo-advisers showed a lot of promise when Stockspot burst onto the scene in 2014 and several offshoots trailed thereafter: Low cost, automated, professional management for investors with amounts as little as rounding differences. But robo-advice has not taken Australia by storm as previously feared. Distrust in robos is also an undercurrent of hesitation as study after study shows that investors still want to be guided by an expert with a pulse. A 2020 survey by the CFA Institute finds 62% of Australians want professional advice from a person - not from a software. Australian robos, at best, automatically direct investors to listed vanilla securities, namely managed funds, ETFs, and cash, following a questionnaire to determine their risk profile. Some offer portfolio rebalancing or an ESG filter, but oftentimes, there are very little points of differentiation. Deloitte segmented robo-advice into four distinct phases (Figure 1). As at 2016, Deloitte estimated that 80% of German, EU, UK, and US robos have 3.0 capabilities and are pushing toward increasing automation. Australia seems to have graduated phase 2.0 but is wallowing in phase 3.0. Figure 1: Robo-Advisory evolution: Digital wealth management from 1.0 to 4.0

Source: Deloitte 2016 The advancement of US robo-advisers, meanwhile, has been instrumental in democratising wealth management and financial advice for the masses, evolving their offerings to include, amongst other things, direct indexing, tax-loss harvesting, and retirement and home-ownership planning. The original robo-advisers, Betterment and Wealthfront, began operating in 2008, and now boast US$40 billion and US$43 billion in AUM respectively. It would be years later that the biggest players in wealth management make a play for robo-advice, quickly eclipsing the market share of standalone robos. Vanguard's Personal Advisor Services, a hybrid human and digital offering, opened to the public in May 2015. Four years later, it launched Digital Advisor, its pureplay automated adviser. Personal Advisor currently has $271 billion in assets while Digital Advisor manages $13 billion. Charles Schwab also launched its digital investing service in 2015 with Intelligent Portfolios. Ranking US robo-advisers based on AUM is scattered at best. New Jersey-based wealth management firm Condor Capital, which keeps a close eye on the US robo market, says that the likes of Schwab and Vanguard entered the market with vast pools of existing clients and household brand names. "Each Betterment or Wealthfront client must be a new-to-platform client; Schwab and Vanguard have the much easier path of converting existing clients into digital advice products," Condor Capital says. Major institutions partnering with start-ups has long been a tradition in wealth management. UBS contemplated acquiring Wealthfront in January 2022 but rescinded its offer tipped to be worth US$1.4 billion. Getting cold feet also appears to have trickled to the local sector. "In wealth management, companies and senior executives are not rewarded for taking risks currently. A lot of companies are actually playing it safe," says Worn. "So, the lack of entrepreneurial spirit and risk appetite means that a lot of these smaller tech companies are not getting the traction in Australia that perhaps you would in other markets, where we commonly see businesses like JB Were and Goldman Sachs, which tend to be wealthy, either acquiring or partnering with startups because that helps them move faster." Worn hopes that this changes in Australia - for the sake of the fintech industry. "There are a lot of great small companies that do need a good institutional partner," he says. Robo-advice might be a small corner of the fintech ecosystem, it does, however, echo what is unfolding in the broader venture capital industry. Venture capital deals in the US nosedived 37% during January and July, while the value of deals plunged 51% to US$70 billion, according to GlobalData. The UK follows the same path, with volumes and values dropping 28% and 54% respectively. "When the tide goes out with venture capital funding, it tends to move very quickly and all in one direction. Investors can either be very greedy or very fearful," Worn says. "At the moment we're in a real fear stage." He expects more of these businesses to either shut down or find "angel acquirers". "The reality is that a lot of the startup investments are going into other technologies, particularly generative AI, which is where everyone wants to place their bets," he says. For robo-advisers struggling to keep their heads above water, Garrett's advice is "to understand that sometimes timing is everything". "I feel that Six Park may have come to market a bit early, given the slow pace of awareness and adoption, which can be very expensive to influence in an industry like financial services, especially in Australia. Sometimes a little luck helps, so be ready for the wait and when the window opens up," he says. |

Latest News

ASIC funding levy to charge advisers $46.2m

ASIC releases new relief for reportable situations regime

TA Associates invests in Viridian Financial Group

Shaw and Partners splashes $63m for New Zealand expansion

Cover Story

Moving mountains

FOUNDER & FINANCIAL PLANNER

MAZI WEALTH